urgent advice needed.

#1

so as some of you may recall I recently leased an 2016 Ftype S in September 2015. 4 months into my lease and I still dream about the V8. so, I have been in talks with my nearest jaguar dealer about my options. I am currently in talks over the following deal and I wanted your input. when I say 'currently', I mean that if you guys think it's a good deal, I'll go tomorrow and pull the trigger:

they take my S, I tried lease to lease but my residual was like 20k.

and they give me their R. since lease was too much negative equity, they suggested I think of financing it. the numbers they're giving me for financing it are:

84months

10k down

1600 per month

this is for a 2016 R with an MSRP of 102k.

do you guys think I'm being stupid or does this make sense? should I go for it? please advise as soon as possible.

thanks much.

they take my S, I tried lease to lease but my residual was like 20k.

and they give me their R. since lease was too much negative equity, they suggested I think of financing it. the numbers they're giving me for financing it are:

84months

10k down

1600 per month

this is for a 2016 R with an MSRP of 102k.

do you guys think I'm being stupid or does this make sense? should I go for it? please advise as soon as possible.

thanks much.

#2

so as some of you may recall I recently leased an 2016 Ftype S in September 2015. 4 months into my lease and I still dream about the V8. so, I have been in talks with my nearest jaguar dealer about my options. I am currently in talks over the following deal and I wanted your input. when I say 'currently', I mean that if you guys think it's a good deal, I'll go tomorrow and pull the trigger:

they take my S, I tried lease to lease but my residual was like 20k.

and they give me their R. since lease was too much negative equity, they suggested I think of financing it. the numbers they're giving me for financing it are:

84months

10k down

1600 per month

this is for a 2016 R with an MSRP of 102k.

do you guys think I'm being stupid or does this make sense? should I go for it? please advise as soon as possible.

thanks much.

they take my S, I tried lease to lease but my residual was like 20k.

and they give me their R. since lease was too much negative equity, they suggested I think of financing it. the numbers they're giving me for financing it are:

84months

10k down

1600 per month

this is for a 2016 R with an MSRP of 102k.

do you guys think I'm being stupid or does this make sense? should I go for it? please advise as soon as possible.

thanks much.

#3

I mean, you are definitely taking a large hit from moving to the R so soon after getting the S. That payment amount for that term with a 10k downpayment is pretty brutal.

That being said, what's the point of spending money on a car if it isn't to bring you happiness?

If you can afford it, do it! There's no point in spending more money than you already have on the S if you know the R is what you really want.

BTW, strictly speaking there's no reason you have to go to your local dealer. I'd at least rate shop with one (I'd recommend the one from the attaboy thread someone else posted), because any place can ship you a car and the difference might make it worth it.

That being said, what's the point of spending money on a car if it isn't to bring you happiness?

If you can afford it, do it! There's no point in spending more money than you already have on the S if you know the R is what you really want.

BTW, strictly speaking there's no reason you have to go to your local dealer. I'd at least rate shop with one (I'd recommend the one from the attaboy thread someone else posted), because any place can ship you a car and the difference might make it worth it.

Last edited by LobsterClaws; 01-27-2016 at 05:29 PM.

#4

#5

#7

So, it's 350 a month more + 10k down to get the car you want? I'd say check for a better deal other places first, and if there aren't any, do it and enjoy.

To know whether waiting a year would be better you'd need to do the math on how much more your car will depreciate vs what you'll have left on the lease. Also, there's more than the financial aspect to it. How much will you enjoy driving for the next year if you know the whole time that what you really want is a different car and you are just waiting it out?

To know whether waiting a year would be better you'd need to do the math on how much more your car will depreciate vs what you'll have left on the lease. Also, there's more than the financial aspect to it. How much will you enjoy driving for the next year if you know the whole time that what you really want is a different car and you are just waiting it out?

Trending Topics

#8

#10

Sounds like a poor deal.

Since you aren't totally sure on the car, and can't lease base on the dealership, you would be prime for something like PenFed's payment saver loan. Car is yours, sell to get out of it at any time.

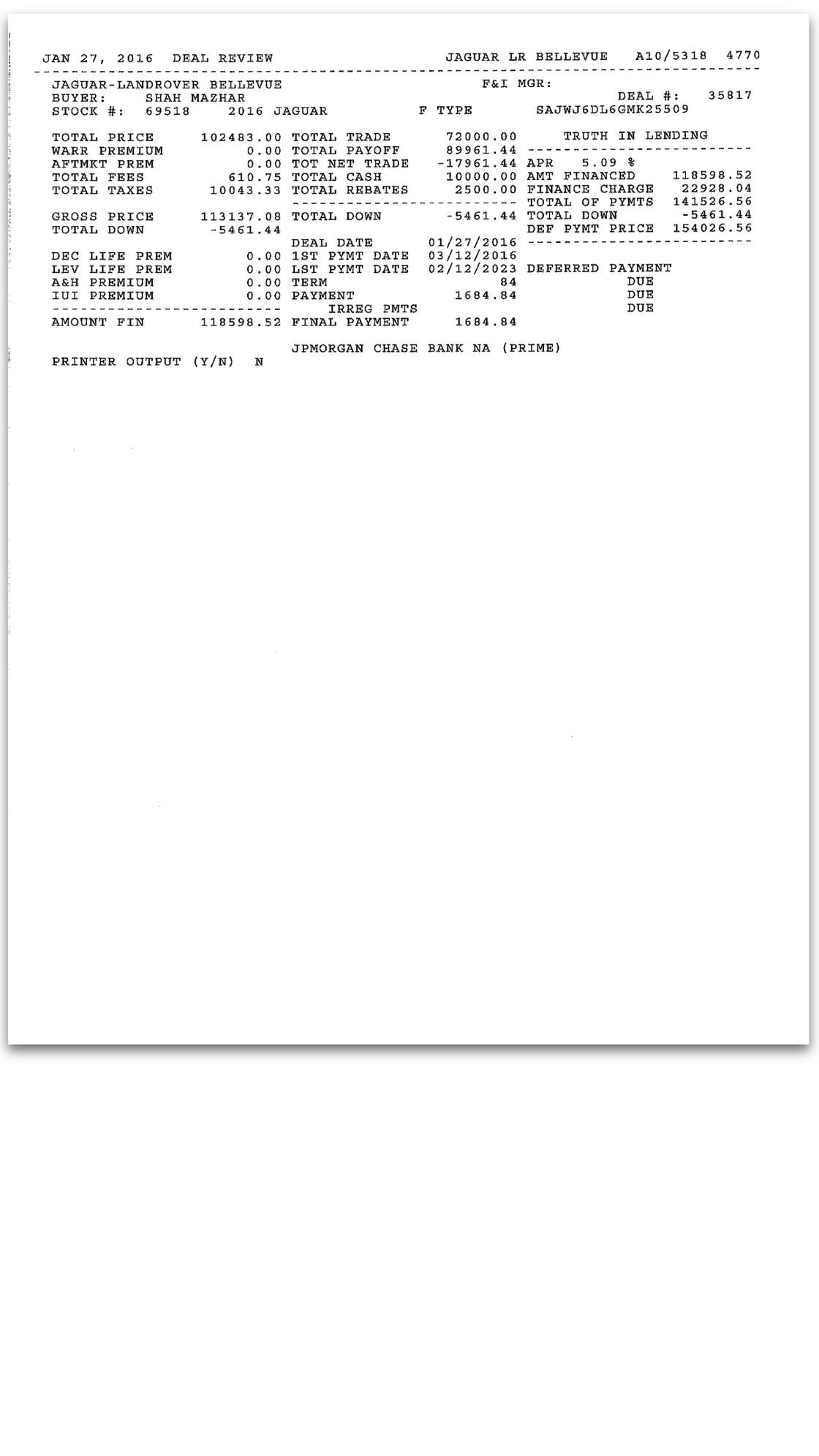

I plugged in your numbers:

$113,137 total cost (with taxes etc)

$13,137 down

$100k financed (since they will only go up to $100k in their online calculator)

36 Months at 1.74%

Payment is $1410

Residual: $54,660

60 Months at 2.49%

Payment is: $1174

Residual: $39,449

Since you aren't totally sure on the car, and can't lease base on the dealership, you would be prime for something like PenFed's payment saver loan. Car is yours, sell to get out of it at any time.

I plugged in your numbers:

$113,137 total cost (with taxes etc)

$13,137 down

$100k financed (since they will only go up to $100k in their online calculator)

36 Months at 1.74%

Payment is $1410

Residual: $54,660

60 Months at 2.49%

Payment is: $1174

Residual: $39,449

#11

So, difficult isn't really a thing. People will always be happy to take the car off of your hands. The real question is how expensive will it be. This is where you need to do the math.

Take the total loan amount, subtract out what your payments + down payment will equal in two years. (don't forget to account for interest) That's how much you'll still owe on the car.

Now, do some depreciation math and take a swag at how much the car will be worth in two years.

Take the first number and subtract the second. That's how much it would cost to bail on the loan in 2 years.

Take the total loan amount, subtract out what your payments + down payment will equal in two years. (don't forget to account for interest) That's how much you'll still owe on the car.

Now, do some depreciation math and take a swag at how much the car will be worth in two years.

Take the first number and subtract the second. That's how much it would cost to bail on the loan in 2 years.

#12

Sounds like a poor deal.

Since you aren't totally sure on the car, and can't lease base on the dealership, you would be prime for something like PenFed's payment saver loan. Car is yours, sell to get out of it at any time.

I plugged in your numbers:

$113,137 total cost (with taxes etc)

$13,137 down

$100k financed (since they will only go up to $100k in their online calculator)

36 Months at 1.74%

Payment is $1410

Residual: $54,660

60 Months at 2.49%

Payment is: $1174

Residual: $39,449

Since you aren't totally sure on the car, and can't lease base on the dealership, you would be prime for something like PenFed's payment saver loan. Car is yours, sell to get out of it at any time.

I plugged in your numbers:

$113,137 total cost (with taxes etc)

$13,137 down

$100k financed (since they will only go up to $100k in their online calculator)

36 Months at 1.74%

Payment is $1410

Residual: $54,660

60 Months at 2.49%

Payment is: $1174

Residual: $39,449

Also, there may still be a $2500 rebate for going with Jag financial. I chose that over the more attractive PenFed product since the interest rates were comparable.

(deleted note about what PenFed offered me because I can't pull it up anymore and I'm not 100% sure on those numbers).

Last edited by LobsterClaws; 01-27-2016 at 06:13 PM.

#13

If he's getting quoted 5.09% from Jag financial I'm not sure he'll get the 1.74 from PenFed, but it's worth a shot.

Also, there may still be a $2500 rebate for going with Jag financial. I chose that over the more attractive PenFed product since the interest rates were comparable.

Also, there may still be a $2500 rebate for going with Jag financial. I chose that over the more attractive PenFed product since the interest rates were comparable.

I can't do math on the cars worth in 2 years because there are too many u known variables at this time. and because I suck at mental math

#15

#16

Well, 5.09% is terrible, but having no idea about your credit history maybe it's what you are stuck with.

As for the deal itself, I'm having trouble parsing that sheet you posted. You said MSRP of the car is $102k? What is the actual price of the car as they are selling it to you?

As for the deal itself, I'm having trouble parsing that sheet you posted. You said MSRP of the car is $102k? What is the actual price of the car as they are selling it to you?

#17

You are getting a pretty good price on the car considering that sticker on that unit is $110483. The price they are selling it to you for is around invoice but you're taking a bath with the negative equity on the S and with the interest rate.

Last edited by WhiteTardis; 01-27-2016 at 06:48 PM.

#18

#19

#20

That deal to my mind is pretty poor. The selling price on the car seems ok, but the trade in is something where you may have room for negotiation and the finance rate you're being offered is simply terrible. If they want the deal more than you do, and these cars are NOT flying off the lot, I'd push them hard on both. Ultimately you have to do what makes you happy, and for that reason alone the deal may be worth it to you but for me it's a poor one.